The Power of Laddering Multi-Year Guaranteed Annuities

The Power of Laddering Multi-Year Guaranteed Annuities

Similar to certificates of deposits (CDs), a multi-year guaranteed annuity (MYGA) locks in an interest rate for a specific period of time. An alternative to a bond, a MYGA might be a good retirement savings strategy for individuals looking for premium protection, and guaranteed interest accumulation.

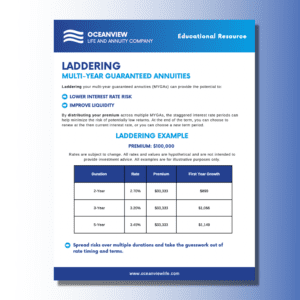

While incorporating a MYGA into a diversified portfolio can help grow retirement income, laddering MYGAs have increasingly become a popular strategy to position assets for better liquidity and lower interest rate risk.

So, What Does It Mean to Ladder a MYGA?

No one can predict if rates will go up, down, or remain the same over a certain period of time. If interest rates are low, one might not want to lock up funds for an extended period if the opportunity arises to allocate premium toward a higher interest rate. By distributing premiums across multiple MYGAs, the staggered interest rate periods can help minimize the risk of potentially low returns.

Work with Oceanview Life and Annuity Company to spread risks over multiple durations and take the guesswork out of rate timing and terms.