Secure your retirement income with the Harbourview Multi-Year Guaranteed

Annuity and enjoy a worry-free future.

Harbourview

MYGA

Multi-Year Guaranteed Annuity Advantages

- Principal Protection

- Guaranteed Interest Rates

- Tax Deferred Earnings

- Lifetime Income Options

Who’s Right For A Fixed Annuity?

Individuals/Couples:

- Whose risk tolerance is shifting towards risk avoidance

- Wants protection from market volatility

- Anticipates limited liquidity needs

- Seeking tax advantages

- Considering guaranteed retirement income options

Download the Harbourview MYGA Brochure

The Harbourview Multi-Year Guaranteed Annuity offers clients a guaranteed premium, guaranteed yield, and the benefits of tax deferral.

Contract Features of the

Harbourview MYGA

- Premium Requirements

Minimum $20,000 - Issue Age

0 through 89 (non-qualified and qualified assets) - Multi-Year Guaranteed Period Options

2, 3, 4, 5, 6, 7 and 10 Years - Withdrawals

10% of Contract Value on or after first year of Contract anniversary without Surrender Change penalty.

Minimum Withdrawal Amount = $250 - Death Benefit

Account Value (No MVA or Surrender Charges) or Spousal continuation option - 20 Day Free Look period to cancel your contract

You may cancel the contract by sending it back to the issuing company. Upon cancellation, the company will return the purchase payment to you. Some states allow for 30 days Free Look. - Market Value Adjustment (MVA)

The MVA is a positive or negative adjustment based on the current interest rate environment at the time of withdrawal. An MVA and a surrender charge will apply if you access more than the 10% free withdrawal before the end of the initial interest rate guarantee period. The MVA does not apply to withdrawals after the surrender charge period, 10% free withdrawals, the death benefit, or when the contract is annuitized.

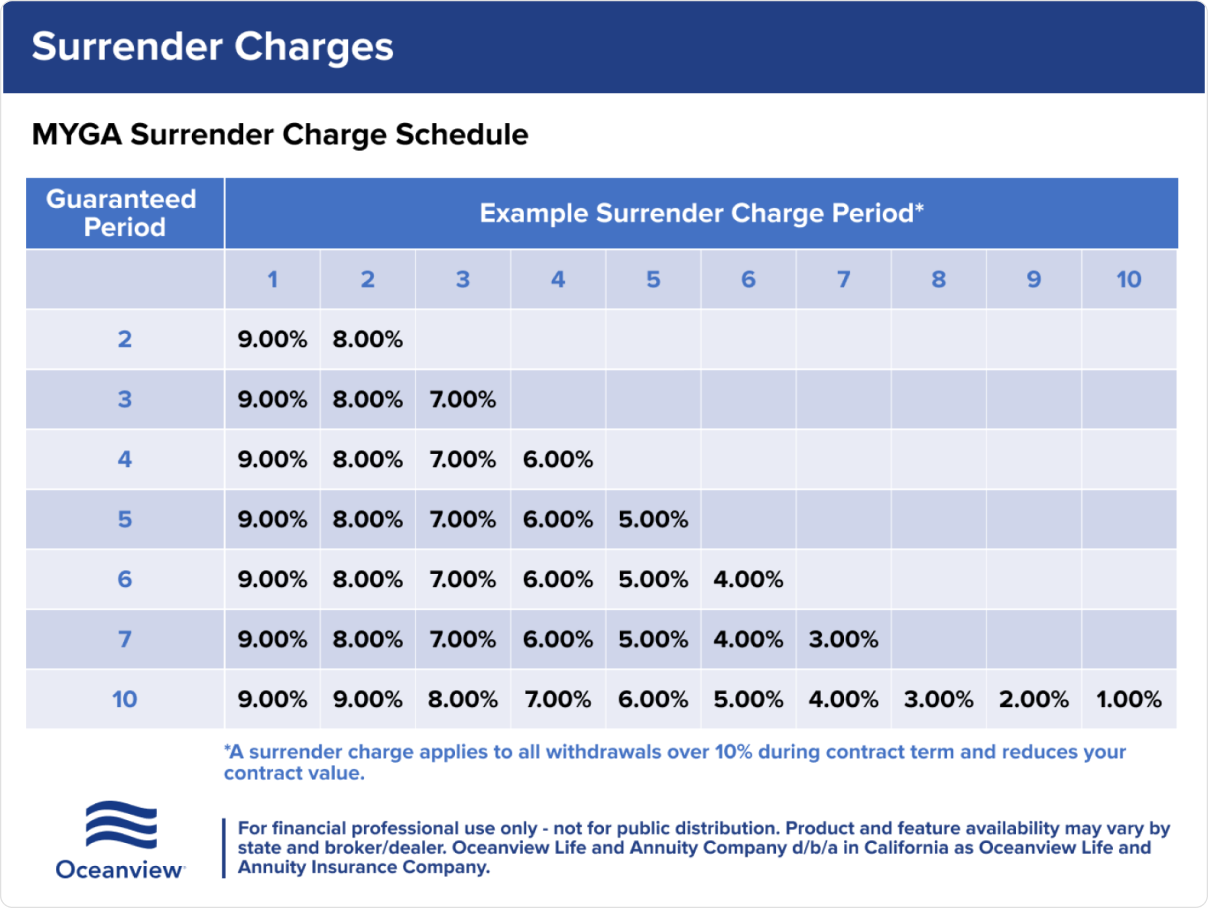

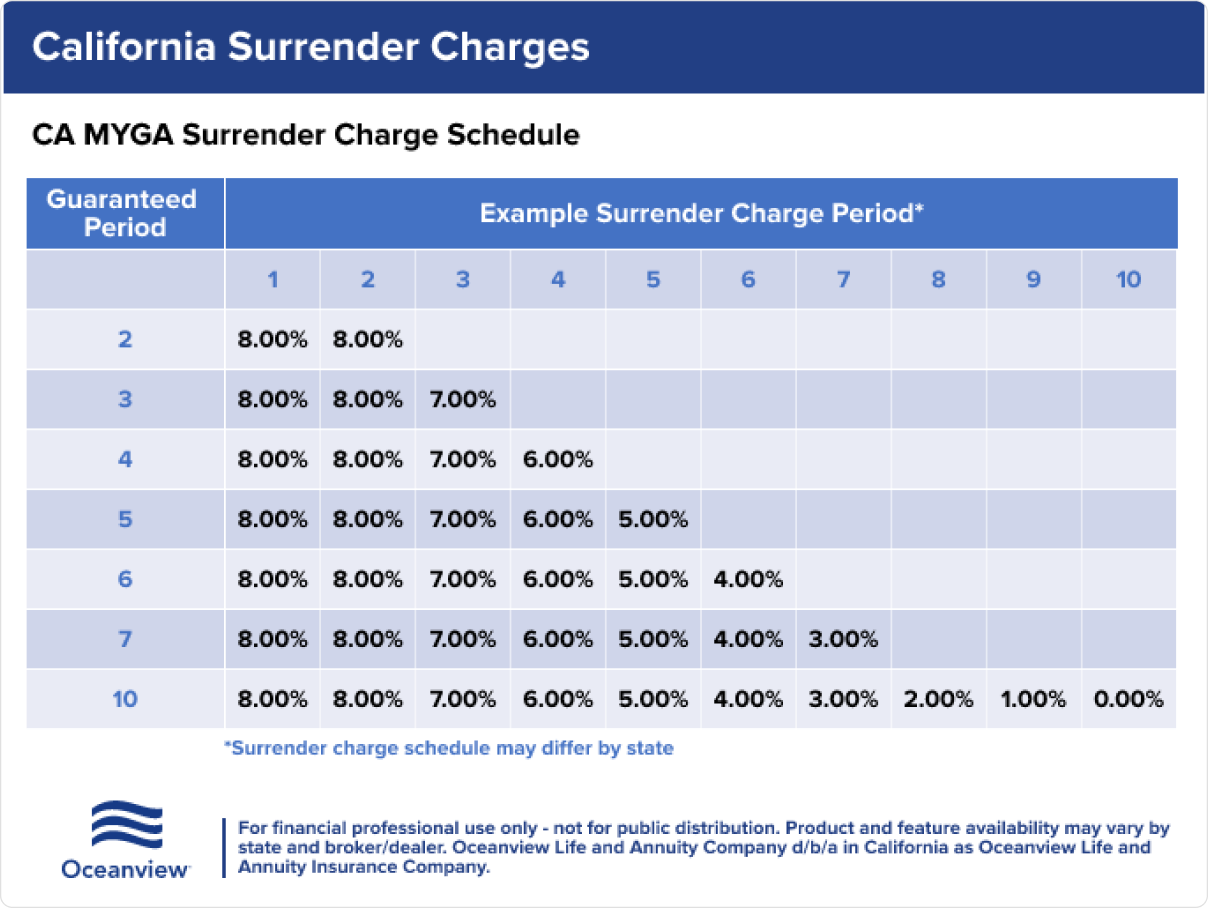

*Please see your contract for additional details. Rider and calculations may vary by state. - Surrender Charges

A surrender charge applies to all withdrawals over 10% during contract term and reduces your contract value.

Contract Renewal Process of the

Harbourview Fixed Annuity

30 Days Prior to the end of the Contract’s Interest Rate Guaranteed Period, the Agent and Policy Holder will be alerted to the following options:

Surrender Contract (not subject to surrender charges or MVA). If client does not make an election, the Contract renews for the same Guarantee Surrender Charge Period at the declared new money rate (never less than 1%).

Apply for a new Contract Guarantee Period of choice with the declared new money rate with a corresponding new Surrender Charge Period.

Take a partial withdrawal (not subject to surrender charges or MVA), and renew the remaining value to the same Guarantee Period or apply to another Guarantee Period.

1035 Exchange Full or Partial account value

Spousal Continuation: This option allows one spouse to continue the other’s contract as the new annuitant. In the event of the death of one spouse, contracts that are jointly owned by spouses or a single-owner contract with a sole spouse beneficiary allow the surviving spouse to assume all rights to the initial agreement. They will have the ability to elect to continue the contract, collect any remaining and all payments and any death benefits and choose beneficiaries, subject to certain conditions. This provision allows for the surviving spouse to maintain a tax- deferred status and secure long- term financial stability.

If no election is made, the Contract will renew for the same Guarantee Period at the declared renewal rate.

Settlement Options of the

Harbourview Fixed Annuity

The Harbourview MYGA can provide an income stream for a term of your choosing, including the rest of your life.

Life Only: Equal monthly payments for the annuitant’s remaining lifetime. Payments will end with the payment due just before the annuitant’s death.

Life with 10-Year Period Certain: Equal monthly payments for the greater of 120 months or the annuitant’s remaining lifetime.

Joint and Last Survivor: This option provides payments during the lifetime of the annuitant and the lifetime of a designated second person. If at the death of the survivor, annuity payments have been made for less than 120 monthly periods, the remaining guaranteed annuity payments will be continued to the beneficiary.

*Once annuity payments have begun, no changes can be made.

*For most states, Harbourview Fixed Annuities Policy Form: ICC19OLASPDA. Product features, options, form numbers and availability may vary by state.This is a brief description of the Harbourview Fixed Annuities and is meant for informational purposes only. It is not individualized to address any specific investment objective. It is not intended as investment or financial advice.

Product availability may vary by distribution channel.