The Oceanview Horizon MYGA is a Single Premium Deferred Annuity primarily intended for customers seeking a retirement savings accumulation vehicle.

Oceanview

Horizon

Multi-Year Guaranteed Annuity Advantages

- Principal Protection

- Guaranteed Interest Rates

- Tax Deferred Earnings

- Lifetime Income Options

Who Should Consider A Fixed Annuity?

Individuals or Couples who:

- Are becoming more risk-averse and want protection from market volatility

- Expect minimal short-term liquidity needs

- Are looking for tax-deferred growth advantages

- Desire options for guaranteed retirement income

Download the Oceanview Horizon MYGA Brochure

The Oceanview Horizon Multi-Year Guaranteed Annuity offers clients a guaranteed premium, guaranteed yield, and the benefits of tax deferral.

Contract Features of the

Oceanview Horizon MYGA

- Premium Requirements

Minimum $20,000 - Issue Age

0 through 89 (non-qualified and qualified assets) - Multi-Year Guaranteed Period Options

3, 5, 7 and 10 Years - Non-Renewing

Following the Initial Interest Rate Guarantee Period, the contract will automatically continue into a Subsequent Interest Guarantee Period of one year, during which it will earn interest at the then-current annual rate declared by the Company. This interest rate will not be less than the contract’s Minimum Guaranteed Interest Rate. The contract may continue through multiple one-year Subsequent Interest Guarantee Periods, subject to the Company’s declared rates at the start of each period. - Optional Free Partial Withdrawal Rider

The Base product does not include free withdrawals, but this can be added as an optional rider at issue with a rate adjustment. If the Free Partial Withdrawal Rider is elected, up to 10% of the account value can be withdrawn every year, including the first year, without the application of a Surrender Charge or an MVA. - Death Benefit

Account Value (No MVA or Surrender Charges) or Spousal continuation option - Market Value Adjustment (MVA)

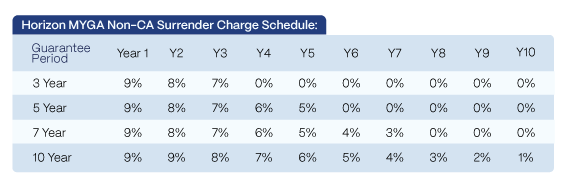

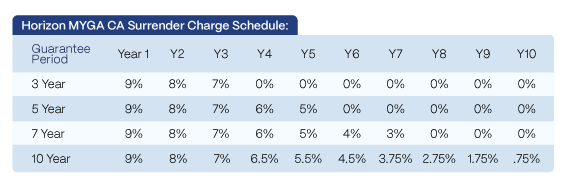

The MVA applies to withdrawals taken during the Initial Guarantee Period and is a positive or negative adjustment based on the current interest rate environment at the time of a withdrawal. An MVA does not apply to withdrawals taken after the Initial Guarantee Period, withdrawals taken under a Free Partial Withdrawal Rider that are less than 10% a year, death benefits, or annuitizations. - Surrender Charges

A surrender charge potentially applies to withdrawals during the Initial Guarantee Period, according to the Surrender Charge Schedule of the Guarantee Period elected. Surrender Charges do not apply to withdrawals taken after the Initial Guarantee Period, withdrawals taken under a Free Partial Withdrawal Rider that are less than 10% a year, death benefits, or annuitizations over 10% during contract term, and reduces your contract value.

Waiver Provisions of the

Oceanview Horizon MYGA

Nursing Home Confinement Surrender Charge Waiver:

- Surrender charges waived if the contract owner is confined to a nursing home for at least 90 consecutive daysor for a total of 90 days with no more than a 6-month break in confinement

- Confinement must be prescribed by a qualified physician and be medically necessary

- Proof must be furnished during confinement or within 90 days after confinement

Terminal Illness Surrender Charge Waiver:

- Surrender charges waived if the contract owner becomes terminally ill and is not expected to live more than 12 months

- Terminal illness must be diagnosed by a qualified physician after the contract’s issue date

- Proof of terminal illness must be provided to the Company

Settlement Options of the

Oceanview Horizon MYGA

The Harbourview Horizon MYGA can provide an income stream for a term of your choosing, including the rest of your life.

Life Only: Equal monthly payments for the annuitant’s remaining lifetime. Payments will end with the payment due just before the annuitant’s death.

Life with 10-Year Period Certain: Equal monthly payments for the greater of 120 months or the annuitant’s remaining lifetime.

Joint and Last Survivor: This option provides payments during the lifetime of the annuitant and the lifetime of a designated second person. If at the death of the survivor, annuity payments have been made for less than 120 monthly periods, the remaining guaranteed annuity payments will be continued to the beneficiary.

*Once annuity payments have begun, no changes can be made.

*For most states, Harbourview Fixed Annuities Policy Form: ICC19OLASPDA. Product features, options, form numbers and availability may vary by state.This is a brief description of the Harbourview Fixed Annuities and is meant for informational purposes only. It is not individualized to address any specific investment objective. It is not intended as investment or financial advice.

Product availability may vary by distribution channel.