Interest rate risk is the potential for changes in interest rates to impact the value of investments or the income generated from those investments. In a low interest rate environment, retirement savings may grow more slowly, making it challenging to accumulate sufficient funds for a comfortable retirement.

Interest Rate Risk

Understanding Interest Rate Risk and the Role of Fixed Indexed Annuities in Mitigating This Risk

The Impact of Low Interest Rates on Retirement Savings

When interest rates are low, traditional savings vehicles like bank certificates of deposit (CDs) and bonds may not provide enough growth to keep pace with inflation. This can make it difficult for retirees to maintain their purchasing power over time.

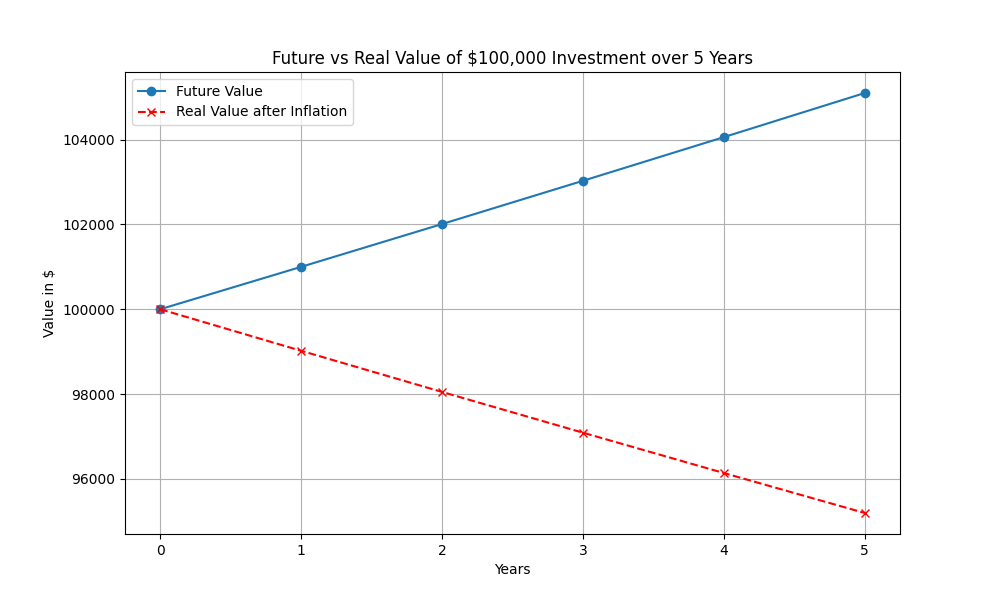

For example, consider a $100,000 investment in a 5-year CD with a 1% annual interest rate. After 5 years, the CD would be worth $105,101. However, if the annual inflation rate during this period is 2%, the real value of the investment would have decreased to $95,193.22, as shown in the visual below:

In this scenario, the low interest rate environment has led to a loss of purchasing power over time, undermining the investor’s retirement savings goals.

Fixed Indexed Annuities (FIAs) as a Solution

FIAs offer a compelling alternative to traditional savings vehicles in a low interest rate environment. By providing the potential for growth based on the performance of selected indices, FIAs can help retirement savings keep pace with inflation. At the same time, FIAs protect the principal investment against market losses, making them a safer option than direct investment in equities.

Key features of FIAs that can help mitigate interest rate risk include:

- Growth Potential: FIAs offer the opportunity for growth based on the performance of one or more indices, such as the S&P 500 or Nasdaq-100. This growth potential can help retirement savings outpace inflation over time.

- Principal Protection: FIAs safeguard the initial investment against market downturns, ensuring that the contract value does not decrease due to negative index performance. This protection is crucial for preserving retirement savings in a low interest rate environment.

- Guaranteed Income: Many FIAs offer the option to convert the contract value into a guaranteed lifetime income stream. By providing a reliable source of income that is not directly tied to interest rates, FIAs can help retirees maintain their desired lifestyle even when interest rates are low.

- Tax-Deferred Growth: Earnings within an FIA grow tax-deferred until withdrawals begin, allowing for potentially greater accumulation over time compared to taxable savings vehicles.

Oceanview's Harbourview Fixed Indexed Annuity

The Harbourview FIA, offered by Oceanview Life and Annuity Company, provides several features that can help address inflation risk:

- Potential for Growth Linked to Market Indices: The Harbourview FIA offers multiple index crediting strategies tied to well-known market indices like the S&P 500, Nasdaq-100, and Russell 2000. If these indices perform well, your annuity value can grow, potentially outpacing inflation.

- Protection from Market Downturns: While the Harbourview FIA allows you to participate in potential market gains, your principal is protected from market losses. This means even if the market experiences a downturn, your annuity value won’t decrease, safeguarding your retirement savings from the negative effects of inflation during those periods.

Conclusion

In a low interest rate environment, retirement savings held in traditional vehicles like CDs and bonds may struggle to keep pace with inflation. Fixed Indexed Annuities, such as Oceanview’s Harbourview FIA, offer a compelling solution by providing growth potential, principal protection, and guaranteed lifetime income options. By incorporating FIAs into their clients’ retirement strategies, financial professionals can help retirees navigate the challenges of interest rate risk and maintain their desired lifestyle.

Why Choose Oceanview?

- Strength: Oceanview has an “A” Excellent rating from A.M. Best, reflecting our stability and reliability.

- Transparency: We believe in clear, straightforward communication. Our products are easy to understand, helping you make informed decisions about your financial future.

- Competitive Rates: Our special introductory rates on select crediting strategies provide an added incentive to start your retirement journey with us.

- Supportive: Our dedicated team is committed to providing exceptional customer service and support throughout your retirement journey.

Take the Next Step Toward a Secure Retirement

Don’t let retirement risks jeopardize your financial future. Schedule a consultation with your financial professional today to learn how Oceanview’s Fixed Indexed Annuities can help you build a retirement plan that weathers any storm. With competitive rates, excellent financial strength, and a commitment to your success, Oceanview is your partner in retirement security.

To learn more or to schedule a meeting with an Oceanview Life representative, please contact:

Oceanview Life and Annuity Company

(833) 656-7455

Disclosures:

This material is a general description intended for general public, educational use. Oceanview Life and Annuity Company is providing investment advice for any individual or in any individual situation, and therefore nothing in this should be read as investment advice. Please reach out to your financial professional if you have any questions. May

not be available in all states. Policy form numbers and provisions may vary. Rates are guaranteed depending on the guarantee period selected at policy issue. Within 30 days prior to the end of the Initial Interest Guarantee Period, we will send our contract holder a notification informing them the date the Guarantee Period is ending and provide the renewal rate and Surrender Charges in effect for the subsequent Guarantee Period. Excess withdrawals are subject to a Surrender Charge. The IRS may impose a penalty

for withdrawals prior to age 59 1/2. All annuity features, risks, limitations, and costs should be considered prior to purchasing an annuity within a tax-qualified retirement plan. Annuities issued by Oceanview Life and Annuity Company, 1819 Wazee St, 2nd Floor, Denver, CO 80202. www.oceanviewlife.com.

Oceanview Life and Annuity Company nor any of its representatives may provide tax or legal advice. While care was taken in compiling this information, the Company reserves the right to correct any typographical errors that may exist. In California, doing business as Oceanview Life and Annuity Insurance Company.

HARBOURVIEW ANNUITIES ARE PRODUCTS OF THE INSURANCE INDUSTRY AND NOT GUARANTEED BY ANY BANK NOR INSURED BY FDIC OR NCUA/NCUSIF. MAY LOSE VALUE. NO BANK/CREDIT UNION GUARANTEE. NOT A DEPOSIT. NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY. MAY ONLY BE OFFERED BY A LICENSED INSURANCE AGENT. GUARANTEES ARE SUBJECT TO THE CLAIM PAYING ABILITY OF THE ISSUING INSURANCE COMPANY

The S&P 500 Annual Point to Point with Cap Rate, S&P 500 Annual Point to Point with Participation Rate, S&P 500 2 Year Point to Point with Participation Rate and S&P 500 Monthly Average Annual Point to Point with Cap Rate, S&P 500 Daily Risk Control 5% Excess Return Index Annual Point-to-Point with Participation Percentage, S&P 500 Daily Risk Control 10% Excess Return Index Annual Point-to-Point with Participation Percentage (hereafter Indices or Index) are products of S&P Dow Jones Indices LLC or its affiliates (“SPDJI”) and Third-Party Licensor, and has been licensed for use by Oceanview Life and Annuity Company (hereafter, Licensee). S&P®, S&P 500®, US 500, The 500, iBoxx®, iTraxx® and CDX® are trademarks of S&P Global, Inc. or its affiliates (“S&P”); Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC (“Dow Jones”); any Third Party Licensor Trademarks are trademarks of the Third-Party Licensor and these trademarks have been licensed for use by SPDJI and sublicensed for certain purposes by the Licensee. It is not possible to invest directly in an index. Licensee’s Products are not sponsored, endorsed, sold or promoted by SPDJI, Dow Jones, S&P, any of their respective affiliates (collectively, “S&P Dow Jones Indices”) or any Third-Party Licensor. Neither S&P Dow Jones Indices nor any Third-Party Licensor make any representation or warranty, express or implied, to the owners of the Licensee’s Products or any member of the public regarding the advisability of investing in securities generally or in Licensee’s Products particularly or the ability of the Indices to track general market performance. Past performance of an index is not an indication or guarantee of future results. S&P Dow Jones Indices’ and any affiliated Third-Party Licensor’s only relationship to Licensee with respect to the Indices is the licensing of the Indices and certain trademarks, service marks and/or trade names of S&P Dow Jones Indices and/or its licensors. The Indices are determined, composed and calculated by S&P Dow Jones Indices or an affiliated Third-Party Licensor without regard to Licensee or the Licensee’s Products. S&P Dow Jones Indices and any affiliated Third-Party Licensor have no obligation to take the needs of the Licensee or the owners of Licensee’s Products into consideration in determining, composing or calculating the Indices. S&P Dow Jones Indices and any affiliated Third-Party Licensor have no obligation or liability in connection with the administration, marketing or trading of the Licensee’s Products. There is no assurance that investment products based on the Indices will accurately track index performance or provide positive investment returns. S&P Dow Jones Indices LLC is not an investment adviser, commodity trading advisory, commodity pool operator, broker dealer, fiduciary, promoter” (as defined in the Investment Company Act of 1940, as amended), “expert” as enumerated within 15 U.S.C. § 77k(a) or tax advisor. Inclusion of a security, commodity, crypto currency or other asset within an index is not a recommendation by S&P Dow Jones Indices to buy, sell, or hold such security, commodity, crypto currency or other asset, nor is it considered to be investment advice or commodity trading advice. NEITHER S&P DOW JONES INDICES NOR ANY AFFILIATED THIRD-PARTY LICENSOR GUARANTEES THE ADEQUACY, ACCURACY, TIMELINESS AND/OR THE COMPLETENESS OF THE INIDICES OR ANY DATA RELATED THERETO OR ANY COMMUNICATION, INCLUDING BUT NOT LIMITED TO, ORAL OR WRITTEN COMMUNICATION (INCLUDING ELECTRONIC COMMUNICATIONS) WITH RESPECT THERETO. S&P DOW JONES INDICES AND ANY AFFILIATED THIRD-PARTY LICENSOR SHALL NOT BE SUBJECT TO ANY DAMAGES OR LIABILITY FOR ANY ERRORS, OMISSIONS, OR DELAYS THEREIN. S&P DOW JONES INDICES AND ANY THIRD-PARTY LICENSOR MAKES NO EXPRESS OR IMPLIED WARRANTIES, AND EXPRESSLY DISCLAIMS ALL WARRANTIES, OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE OR USE OR AS TO RESULTS TO BE OBTAINED BY THE LICENSEE, OWNERS OF THE LICENSEE’S PRODUCTS, OR ANY OTHER PERSON OR ENTITY FROM THE USE OF THE INDICES OR WITH RESPECT TO ANY DATA RELATED THERETO. WITHOUT LIMITING ANY OF THE FOREGOING, IN NO EVENT WHATSOEVER SHALL S&P DOW JONES INDICES OR ANY AFFILIATED THIRD-PARTY LICENSOR BE LIABLE FOR ANY INDIRECT, SPECIAL, INCIDENTAL, PUNITIVE, OR CONSEQUENTIAL DAMAGES INCLUDING BUT NOT LIMITED TO, LOSS OF PROFITS, TRADING LOSSES, LOST TIME OR GOODWILL, EVEN IF THEY HAVE BEEN ADVISED OF THE POSSIBILITY OF SUCH DAMAGES, WHETHER IN CONTRACT, TORT, STRICT LIABILITY, OR OTHERWISE. SUBJECT TO S&P’S OBLIGATIONS TO LICENSEE TO REVIEW AND APPROVE LICENSEE’S INFORMATIONAL MATERIAL PURSUANT TO THE AGREEMENT BETWEEN S&P AND LICENSEE, S&P DOW JONES INDICES HAS NOT REVIEWED, PREPARED AND/OR CERTIFIED ANY PORTION OF, NOR DOES S&P DOW JONES INDIES HAVE ANY CONTROL OVER, THE LICENSEE PRODUCT REGISTRATION STATEMENT, PROSPECTUS OR OTHER OFFERING MATERIALS. THERE ARE NO THIRDPARTY BENEFICIARIES OF ANY AGREEMENTS OR ARRANGEMENTS BETWEEN S&P DOW JONES INDICES AND LICENSEE, OTHER THAN THE LICENSORS OF S&P DOW JONES INDICES.

Nasdaq®, Nasdaq-100 Index®, Nasdaq-100®, NDX®, are registered trademarks of Nasdaq, Inc. (which with its affiliates is referred to as the “Corporations”) and are licensed for use by Oceanview Life and Annuity and affiliated companies. The Product has not been passed on by the Corporations as to their legality or suitability. The Product is not issued, endorsed, sold, or promoted by the Corporations. The Corporations make no warranties and bear no liability with respect to the product.

London Stock Exchange Group plc and its group undertakings (collectively, the “LSE Group”). FTSE Russell is a trading name of certain of the LSE Group companies. “FTSE®” “Russell®”, “FTSE Russell®”, “FTSE4Good®” are trademarks of the relevant LSE Group companies and are used by any other LSE Group company under license. The FIAX Russell 2000® Index (the “Index”) has been licensed for use by Oceanview Life and Annuity Company and affiliated companies (“Oceanview”). Oceanview products are not in any way sponsored, endorsed, sold, or promoted by Russell or the LSE Group and none of the Licensor Parties make any claim, prediction, warranty, or representation whatsoever, expressly or impliedly, either as to (i) the results to be obtained from the use of the Index (upon which the Oceanview product is based), (ii) the figure at which the Index is said to stand at any particular time on any particular day or otherwise, or (iii) the suitability of the Index for the purpose to which it is being put in connection with the Oceanview product. None of the Licensor Parties have provided or will provide any financial or investment advice or recommendation in relation to the Index to Oceanview or to its clients. The Index is calculated by Russell or its agent. None of the Licensor Parties shall be (a) liable (whether in negligence or otherwise) to any person for any error in the Index or (b) under any obligation to advise any person of any error therein.