Longevity Risk is the potential financial risk that individuals may outlive their retirement savings. As life expectancy increases, so does the importance of planning for a longer retirement period.

Longevity Risk

Understanding Longevity Risk and the Role of Fixed Indexed Annuities (FIAs) in Mitigating This Risk

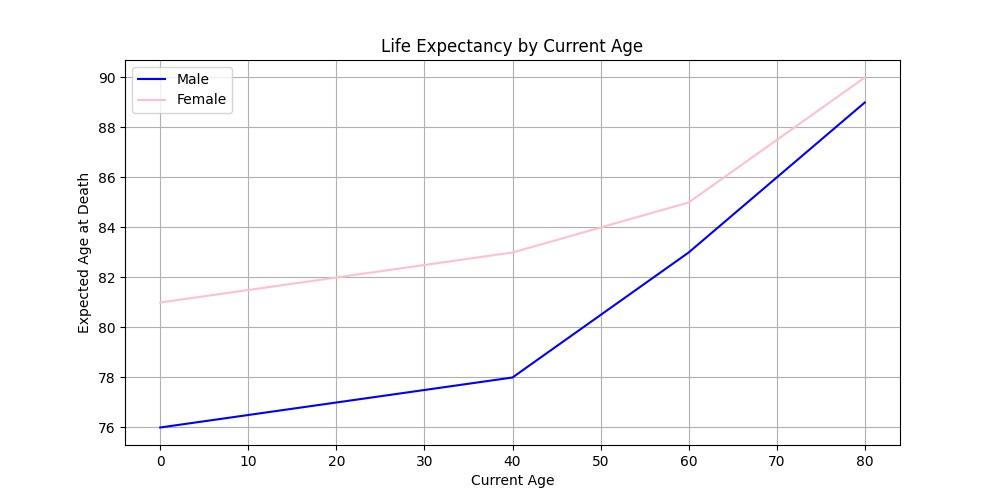

The chart above uses the Social Security Administrations Actuarial Life Tables to illustrate how life expectancy changes based on an individual’s current age and gender. At birth, males in the United States have a life expectancy of 74 years, while females have a life expectancy of 79 years. However, as individuals age, their remaining life expectancy increases.

For example, a 60-year-old male in the US can expect to live to around 82, while a 60-year-old female can expect to live to 85. By age 80, life expectancy reaches 88 for males and 90 for females. This data highlights the importance of planning for a longer retirement, as individuals who reach retirement age are likely to live well into their 80s or even 90s.

The Importance of Planning for Longevity Risk

Failing to plan for longevity risk can have severe consequences. According to a 2019 study by the World Economic Forum, the average U.S. retiree will outlive their savings by 8-13 years. This shortfall can lead to financial stress, reduced quality of life, and increased reliance on family members or government assistance. As life expectancy continues to rise, the need for robust retirement planning solutions becomes increasingly critical.

Fixed Indexed Annuities (FIAs) as a Solution

FIAs are designed to provide principal protection, potential for growth, and a reliable income stream, which makes them an effective tool in addressing longevity risk. Here’s how FIAs can help:

- Principal Protection: FIAs safeguard the initial investment against market downturns, which is crucial for retirees looking to preserve their capital.

- Potential for Growth: FIAs offer the opportunity for growth based on the performance of selected indices without the risk of direct investment in the stock market. The interest credited will never be less than zero, ensuring that the contract value does not decrease due to market volatility.

- Lifetime Income Options: FIAs provide various settlement options, including lifetime income, which guarantees a steady stream of income for the rest of the annuitant’s life. This feature is critical for managing longevity risk as it ensures retirees do not outlive their income.

- Tax-Deferred Growth: Earnings within an FIA grow tax-deferred until withdrawals begin, allowing for a potentially greater wealth accumulation over time.

Compared to other retirement planning options, such as 401(k)s or traditional savings accounts, FIAs offer a unique combination of safety, growth potential, and guaranteed income that can be particularly valuable in addressing longevity risk.

Conclusion

As life expectancy continues to rise, longevity risk poses an increasingly significant challenge to retirement planning. Fixed Indexed Annuities, such as Oceanview’s Harbourview FIA, offer a powerful solution by combining growth potential, principal protection, and lifetime income options. By incorporating FIAs into their clients’ retirement strategies, financial professionals can help enhance financial security and peace of mind in the face of longevity risk.

Why Choose Oceanview?

- Strength: Oceanview has an “A” Excellent rating from A.M. Best, reflecting our stability and reliability.

- Transparency: We believe in clear, straightforward communication. Our products are easy to understand, helping you make informed decisions about your financial future.

- Competitive Rates: Our special introductory rates on select crediting strategies provide an added incentive to start your retirement journey with us.

- Supportive: Our dedicated team is committed to providing exceptional customer service and support throughout your retirement journey.

Take the Next Step Toward a Secure Retirement

Don’t let retirement risks jeopardize your financial future. Schedule a consultation with your financial professional today to learn how Oceanview’s Fixed Indexed Annuities can help you build a retirement plan that weathers any storm. With competitive rates, excellent financial strength, and a commitment to your success, Oceanview is your partner in retirement security.

To learn more or to schedule a meeting with an Oceanview Life representative, please contact:

Oceanview Life and Annuity Company

(833) 656-7455

The Harbourview FIA (Policy Form ICC19 OLA FIA), and any variations is a single premium deferred annuity, and may not be available in all states. Annuities issued by Oceanview Life and Annuity Company, 1819 Wazee Street, 2nd Floor, Denver, CO 80202. www.oceanviewlife.com. A.M. Best Rating as of November 1, 2023, is subject to change. A (Excellent) rating is third highest of fifteen possible rating classes for financial strength. This material is a general description intended for general public, educational use. Refer to the product disclosure and related documents for more information or speak to your financial professional. Oceanview Life and Annuity Company is not providing investment advice for any individual or in any individual situation, and therefore nothing in this correspondence should be read as such. Neither Oceanview nor its representatives provide tax or legal advice. While care was taken in compiling this information, the Company reserves the right to correct any typographical errors that may exist. In California, doing business as Oceanview Life and Annuity Insurance Company.

HARBOURVIEW ANNUITIES ARE PRODUCTS OF THE INSURANCE INDUSTRY AND NOT GUARANTEED BY ANY BANK NOR INSURED BY THE FDIC OR NCUA/NCUSIF OR ANY OTHER FEDERAL GOVERNMENTAL AGENCY. MAY LOSE VALUE. NO BANK/CREDIT UNION GUARANTEE. NOT A DEPOSIT. MAY ONLY BE OFFERED BY A LICENSED INSURANCE AGENT. GUARANTEES ARE SUBJECT TO THE CLAIM PAYING ABILITY OF THE ISSUING INSURANCE COMPANY.